Step-by-Step Guide for Handling ESIC Accidents in India-2025

Introduction

The Employees’ State Insurance Corporation (ESIC), established under the ESIC Act, 1948, provides a social security framework for Indian employees, offering medical care, financial compensation, and rehabilitation for work-related injuries. For HR managers, employers, and safety officers in India, understanding the ESIC accident procedure is vital to ensure employee welfare and legal compliance. Timely and accurate handling of workplace accidents secures benefits like disablement benefits or medical care and prevents penalties under Section 85, such as fines or legal action. This guide details the employer responsibility under ESIC, covering immediate actions, reporting via ESIC Form 12, and claim processes, enriched with real-world case studies to illustrate compliance challenges.

What is an ESIC Accident?

Understanding what ESIC accident is crucial for compliance. Under Section 2(8) of the ESI Act, an “employment injury” is a personal injury caused by an accident or occupational disease arising out of and in the course of employment. This includes industrial injuries (e.g., machinery mishaps) and work-related illnesses but excludes personal accidents unrelated to employment.

Employment Injury vs. Personal Accident

Employment Injury: Covers industrial injuries (e.g., injuries from operating machinery) or occupational diseases (e.g., respiratory issues from chemical exposure). These qualify for ESIC benefits like temporary disablement benefits.

Personal Accident: Injuries outside work (e.g., a fall at home) are not covered under ESIC.

Section 51C: Accidents Happening While Travelling in Employer’s Transport

Under Section 51C, accidents occurring while an employee travels in transport provided or subsidized by the employer are deemed employment injuries, even if off-premises. This extends the ESIC accident definition to cover incidents during company-arranged commutes, such as shuttle buses or cabs. For example, an injury in a factory bus accident qualifies for disablement benefits.

Employers must report these via ESIC Form 12 within 24 hours if they cause death, disablement, or absence. In ESIC v. M. G. Polymers (2012), the Bombay High Court upheld that an employee injured in an employer-provided van accident was entitled to benefits, as the transport was integral to employment. Employers should verify transport arrangements and document incidents promptly in the accident register ESIC to avoid ESIC accident claim rejection reasons due to unclear employment linkage. Why is this critical? It ensures employees injured during employer-organized travel receive timely support.

Section 51D: Accidents Happening While Acting in Breach of Regulations

Under Section 51D, an accident is deemed an employment injury even if the employee was acting in breach of safety regulations or without employer instructions, provided the act was incidental to employment. For example, an employee injured while operating machinery without safety gear may still qualify for disablement benefits if the task was work-related. Employers must report such incidents using ESIC Form 12 within 24 hours for serious cases.

This section emphasizes that non-compliance with safety protocols doesn’t automatically disqualify claims, but employers must document the incident’s context in the accident register ESIC. In a 2023 Karnataka High Court case, an employee’s claim was upheld despite ignoring safety protocols, as the injury occurred during a work task. Why does this matter? It ensures benefits for employees while reinforcing employer responsibility under ESIC to maintain safety standards and accurate records to avoid ESIC accident claim rejection reasons.

Section 51E: Accidents Happening While Commuting to the Place of Work and Vice Versa

Section 51E, introduced in 2010, includes accidents during an employee’s commute to or from work as employment injuries, provided there’s a reasonable connection to employment (e.g., no significant deviation). For instance, a worker injured in a road accident enroute to the workplace may qualify for medical care or temporary disablement benefits.

Employers must report such incidents using ESIC Form 12 within 24 hours for serious cases. In a 2023 Delhi case, an employee’s claim was rejected because the accident occurred during a personal detour, highlighting the need for clear commuting details. Employers should maintain records of work schedules and routes to support claims, ensuring compliance with ESIC accident rules India.

How does this affect HR?

Accurate reporting and KYC updates prevent delays and ESIC accident claim rejection reasons, ensuring employees receive benefits for commuting-related injuries.

Case Study: Regional Director, ESIC v. Francis De Costa (1996 II CLR 812)

Court: Supreme Court of India

Issue: Does an accident while cycling to a bus stop for employer-provided transport qualify as an employment injury?

Facts: An employee died in an accident while cycling to a bus stop to catch a subsidized employer bus. The High Court considered it work-related, but the Supreme Court disagreed.

Ruling: The accident was not an ESIC accident as the employee was not in the employer’s transport at the time, lacking a direct employment link under Section 2(8). This led to the 2010 amendment (Section 51D), which now includes commuting accidents.

Lesson: Employers must verify if an accident aligns with the ESIC accident definition before reporting. How might this case influence your decision to report commuting-related injuries?

Read: Supreme Court on Workman Status: Raghavendra vs. Airtel 2024

Case Study: ESIC v. Suresh Kumar (2023 SCC OnLine Kar 1234)

Court: Karnataka High Court

Issue: Does an accident during a work task, despite breaching safety regulations, qualify as an employment injury under Section 51D?

Facts: An employee was injured while operating heavy machinery without mandated safety gear, against company policy. ESIC initially rejected the claim, citing non-compliance.

Ruling: The court upheld the claim, ruling that the injury was incidental to employment under Section 51D, as the task was work-related. The employer’s failure to enforce safety training was noted.

Lesson: Employers must report all work-related accidents, even if regulations are breached, and maintain robust safety training to meet ESIC accident rules India. How can you ensure safety compliance to avoid such disputes?

Why differentiate? Only employment injuries trigger the ESIC accident procedure, ensuring benefits are correctly allocated.

Read: Top 12 HR Trends in India 2025: Shaping Workplace Culture

Legal Obligation of Employers Under ESIC

The ESIC Act, 1948, mandates employers to provide social security benefits, including medical care and compensation for work-related injuries. Understanding employer responsibility under ESIC ensures compliance and supports employees effectively.

Read: Grievance Redressal in Indian Manufacturing: Guide to ID Act 1947

Who Should Report?

Employers: Legally responsible for reporting accidents for ESIC-covered employees.

Designated Supervisors or HR: May assist, but the employer bears ultimate responsibility.

Contractors: If workers are under a contractor, the principal employer ensures compliance.

What Timeline to Follow?

Within 24 Hours: Report accidents causing death, disablement, or absence from work using ESIC Form 12.

Minor Injuries: Log in the accident register ESIC but may not require Form 12 if no absence occurs.

Fatal Accidents: Immediate reporting is mandatory, including post-mortem details if applicable.

Case Study: Beama Manufacturers (Pvt.) Ltd. v. Regional Director, ESIC, Madras (1990 LLR 364)

Court: Madras High Court

Issue: Can ESIC impose damages for late contribution payments without due process?

Facts: The employer delayed ESI contributions, and ESIC levied damages without considering the employer’s reasons.

Ruling: The court held that ESIC must act judiciously, considering the employer’s explanation for delays. Arbitrary penalties violate employer responsibility under ESIC.

Lesson: Timely reporting and payments are critical to avoid penalties. How can you ensure your organization meets the 24-hour reporting deadline?

Case Study: ESIC v. Venkatachalam Condiments (1995 LLR 691)

Court: Madras High Court

Issue: Is mechanical imposition of damages for delayed contributions valid?

Facts: The employer delayed ESI contributions, and ESIC imposed damages without reviewing the delay’s cause.

Ruling: The court quashed the damages, stating ESIC must consider the employer’s explanation, emphasizing fair process in ESIC accident rules India.

Lesson: Non-compliance, like delayed reporting, risks penalties, but ESIC must follow due process. What systems can you implement to maintain compliance records?

What risks arise from delayed reporting? Late submissions can delay benefits and attract penalties, impacting employee trust and organizational compliance.

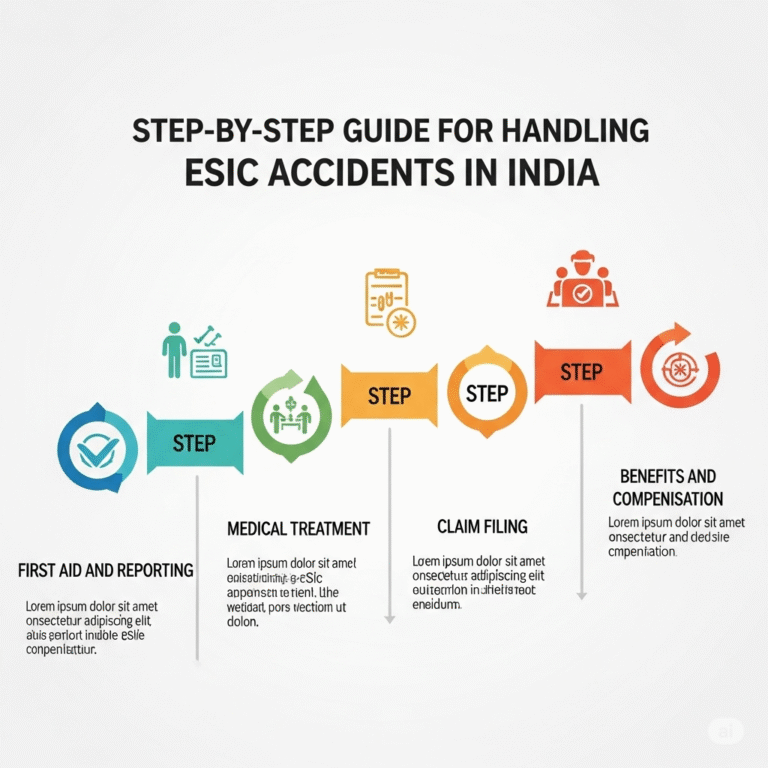

Immediate Steps After an ESIC-Covered Accident: What to Do After an ESIC Accident?

Wondering what to do after an ESIC accident? Prompt action post-accident minimizes injury severity and ensures compliance with ESIC accident rules India. These steps prioritize employee safety and documentation to support the ESIC accident procedure.

Step 1 – Ensure First Aid and Medical Treatment

Assess Safety: Secure the accident site to prevent further harm.

Administer First Aid: Use a workplace first aid ESIC kit for minor injuries like cuts or bruises.

Seek Medical Care: For serious injuries, transfer the employee to an ESIC-approved hospital or dispensary. Call 102 for ambulances if needed.

Document Actions: Record the time, injury details, and first aid ESIC measures taken.

Step 2 – Inform Supervisor and HR Immediately

Notify Supervisor: Alert the employee’s supervisor and HR team within one hour.

Provide Details: Share the accident’s time, location, and initial observations.

Engage Safety Officers: Involve safety personnel to assess workplace hazards.

Step 3 – Record the Incident in Accident Register (Form 11)

The accident register ESIC (Form 11) is a mandatory record for all workplace accidents, ensuring traceability and compliance.

Steps to Record

Access Form 11: Available on the ESIC portal (www.esic.gov.in) or as a physical book.

Enter Details: Include employee’s name, ESIC insurance number, date, time, location, injury description, and witness statements.

Online Submission:

Log in to the ESIC Employer Portal (employer.esic.in).

Navigate to “Accident Register” and upload Form 11 details.

Save the reference number for tracking.

Retention: Keep records for five years as per ESIC accident rules India.

Why maintain an accident register ESIC? Accurate records prevent ESIC accident claim rejection reasons due to missing documentation.

How to Report an ESIC Accident (Form 12 Process)

The ESIC Form 12 is the official accident report, critical for accessing benefits like disablement benefits or medical care.

Step 4 – Submit ESIC Form 12 (Accident Report)

Download Form 12: Available on the ESIC portal.

Fill Details: Include:

Employee’s name, ESIC insurance number, age, and job role.

Accident specifics: date, time, location, cause, and injury details.

Witness names and statements.

Attach Documents: Medical reports, first aid records, and photos (if applicable).

Submission Options:

Online: Via the ESIC Employer Portal (employer.esic.in).

Offline: Submit to the nearest ESIC branch office or dispensary.

Timeline: Within 24 hours for serious or fatal accidents.

Where to submit? Use the ESIC portal for efficiency or deliver to the local ESIC branch office. Timely submission prevents delays in benefit disbursal.

What Happens After Reporting the Accident?

Post-reporting, ESIC processes the claim to provide benefits, ensuring employee recovery and financial support.

Medical Board Review

Assessment: A Medical Board evaluates the injury to determine the extent of disablement (temporary or permanent).

Certification: The board certifies the percentage of earning capacity loss for disablement benefits.

Timeline: Typically completed within 7–14 days post-submission.

Eligibility for Temporary/Disablement Benefits

Temporary Disablement Benefit: 90% of wages for work absence due to injury.

Permanent Disablement Benefit: Monthly payments based on Medical Board assessment.

Dependants’ Benefit: 90% of wages as a pension for families of deceased employees.

Medical Benefit: Full treatment at ESIC facilities.

Funeral Expenses: Up to ₹15,000.

Timeline of Claim Settlement

Initial Processing: 7–10 days for document verification.

Medical Board Review: 7–14 days for disablement assessment.

Benefit Disbursal: Within 30 days for temporary benefits; permanent benefits may take longer.

What ensures smooth settlement? Complete documentation and updated KYC details reduce ESIC accident claim rejection reasons.

Common Mistakes to Avoid

Avoid these pitfalls to ensure compliance and timely benefits:

Delayed Reporting: Missing the 24-hour deadline delays claims and risks penalties.

Incomplete Documentation: Omitting medical reports or witness statements can lead to rejection.

Not Updating Insured Person’s KYC: Outdated ESIC insurance number or bank details cause payment delays.

Ignoring Follow-Up: Failing to track claim status or employee recovery can disrupt the process.

How can employers prevent these? Regular training and organized record-keeping minimize ESIC accident claim rejection reasons.

Compliance Checklist for ESIC Accident Handling

To ensure adherence to the ESIC accident procedure, use this checklist:

Maintain an updated Accident Book (Form 11) at the workplace.

Train staff on first aid and emergency response.

Submit ESIC Form 12 within 24 hours for serious accidents.

Verify employee details, including ESIC insurance number, before reporting.

Retain copies of all forms and supporting documents.

Regularly review workplace safety measures.

About the Author

Nagaraj Bhagoji, Legal Compliance Expert-Free Lancer

Nagaraj is a seasoned HR consultant and legal compliance expert with over 15 years of experience in Indian labor laws, specializing in ESIC accident rules India. he has advised numerous organizations on navigating the ESIC accident procedure, ensuring compliance and employee welfare. His insights help HR managers and employers avoid ESIC accident claim rejection reasons through practical, compliant strategies.

FAQs on ESIC Accident Reporting

What is an ESIC accident?

An ESIC accident is an employment injury under Section 2(8), caused by a work-related incident or occupational disease, qualifying for ESIC benefits.

Where can I get ESIC Form 12?

Download it from the ESIC portal.

Can Form 12 be submitted online?

Yes, via the ESIC Employer Portal (employer.esic.in) for faster processing.

What are common ESIC accident claim rejection reasons?

Delayed reporting, incomplete forms, or outdated KYC details can lead to rejection.

How long does claim settlement take?

Temporary benefits take about 30 days; permanent benefits may take longer post-Medical Board review.

Conclusion

Navigating the ESIC accident procedure is straightforward with proper preparation. By following these steps—first aid ESIC, accident register ESIC entry, ESIC Form 12 submission, and claim facilitation—employers meet their employer responsibility under ESIC while supporting employees. Encourage HR and supervisors to undergo regular training on ESIC accident rules India to ensure compliance. Use the ESIC Employer Portal for efficiency and maintain accurate records to avoid ESIC accident claim rejection reasons. With diligence, the ESIC accident guide for HR becomes a tool for safety, compliance, and employee welfare.