EPFO Simplifies PF Claims: No More Cheque Leaf or Passbook Upload Required!

Navigating the Provident Fund (PF) withdrawal process has long been a source of stress for many employees in India — especially when claims are rejected over minor documentation issues like an unclear cheque leaf or a missing passbook copy.

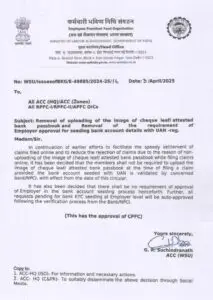

But here’s some great news: the Employees’ Provident Fund Organisation (EPFO) has taken a significant step to make your claim process easier and faster. As per its latest circular, dated April 3, 2025, members are no longer required to upload their cheque leaf or an attested copy of their bank passbook when filing claims — provided the bank account is already validated via NPCI (National Payments Corporation of India).

💡 Why This Update Matters for Every EPF Member.

If you’ve ever submitted an online PF claim — whether it’s for a withdrawal, advance, or pension settlement — you probably know that uploading supporting documents was always a mandatory (and sometimes frustrating) step.

In many cases, claims were rejected not because of eligibility issues, but due to simple document errors:

→ An unclear scan,

→ A mismatched signature, or

→ Missing bank account proof.

The EPFO’s new move eliminates this common roadblock. Now, if your bank account is properly linked and verified with your UAN through NPCI, the system will recognize your bank details without asking for any additional uploads. This streamlines the entire process, making claim settlements faster and less prone to rejection.

🔍 What Changes Under the New EPFO Circular.

Here’s a quick summary of the key points:

No longer need to upload cheque leaves or attested passbooks when your bank account is already validated through Bank/NPCI.

Employer approval for KYC seeding is no longer necessary. Once your bank validates your account, the system auto-approves it — making the process faster and independent of your employer.

This update applies to all claim types, including withdrawals, advances, pension claims, and transfers.

⚙️ Why EPFO Decided to Remove Document Upload Requirements.

This policy change is part of EPFO’s broader mission to make the Provident Fund experience more seamless, digital, and member friendly. Here’s why it matters:

✔️ Speeds up PF claim settlements — fewer manual checks and document uploads mean faster disbursal.

✔️ Reduces rejection rates caused by avoidable document errors.

✔️ Improves trust in digital KYC systems by relying on real-time NPCI validations instead of static document uploads.

In short, this change is designed to ensure that members face fewer administrative hurdles when accessing their hard-earned money.

💡 A Bonus Benefit: Employer Approval for Bank KYC is Also History!

In addition to removing the need for document uploads, EPFO has also eliminated the dependency on employer approval for bank KYC updates.

This is especially helpful for employees who:

Have recently switched jobs,

Are updating their bank account after a change, or

Faced delays in KYC approval due to employer unresponsiveness.

Once your bank validates your account and it’s linked to your UAN, the system will now automatically approve it. This saves you valuable time and removes the risk of claim delays due to employer bottlenecks.

✅ How to Ensure Smooth PF Claims After This Update.

To benefit from this new process, here’s what you should do:

Confirm that your bank account is linked to your UAN in the EPFO portal.

Ensure your bank account has been validated by your bank and confirmed via NPCI.

Once these two steps are completed, you can file your claims online without worrying about document uploads or waiting for employer approval.

More Read: Top 12 HR Trends in India 2025: Shaping Workplace Culture

💡 A Step Forward in Digital Efficiency.

This update signals EPFO’s commitment to creating a more efficient, secure, and user-friendly claim process for employees across the country.

By reducing paperwork and manual dependencies, EPFO is not just improving claim speed but also building trust and transparency in the PF system.

Whether you’re withdrawing your PF for urgent personal needs, a home loan, or planning your retirement, this new rule ensures a much smoother experience from start to finish.

Read: EPF Transfer-New EPFO Rules for Overlap Service-2025

🧾 Frequently Asked Questions (FAQs).

Q1: Do I still need to upload a cheque leaf or passbook for PF withdrawals?

A: No. If your bank account has been validated via NPCI and linked to your UAN, uploading additional bank proof is no longer required.

Q2: Is employer approval still needed for bank KYC updates?

A: No. Once your bank account is verified through NPCI, the system automatically approves the update without employer intervention.

Q3: When did this change take effect?

A: This update came into effect on April 3, 2025, as per the official EPFO circular.

📢 Stay Informed: EPFO Updates and Smart Money Moves

EPFO’s latest update highlights the importance of keeping your UAN details, especially your bank account, up to date. Doing so not only saves you from future claim rejections but also ensures smoother and faster access to your PF when you need it most.

Read Also: EPF Interest Rate 2025: Calculation & Trends